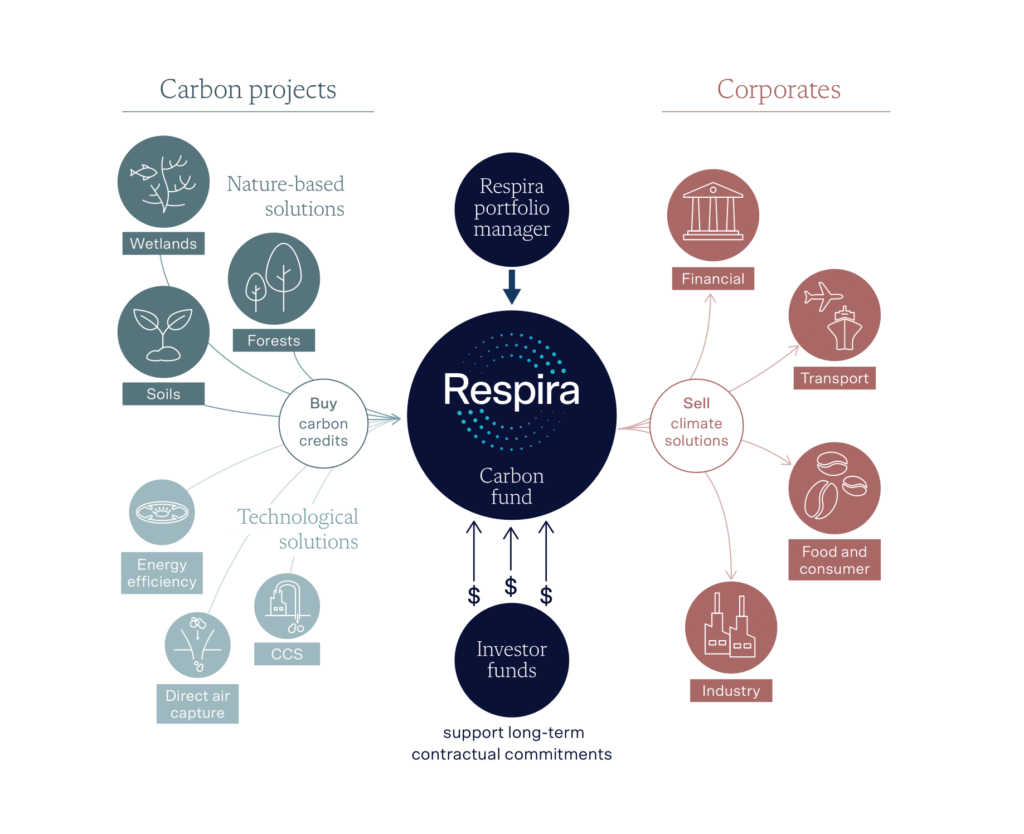

Traditionally, carbon credits have been bought and sold by brokers on a spot basis, but at Respira, we operate differently, and have helped to shift towards a carbon finance model of carbon credit trading. We recognise that the broker approach creates little long-term certainty for carbon communities, and, at times, even curtails the development of high-quality projects. This is why we offer an alternative – a model prioritising the overall stability of our flagship portfolio projects.

Respira is not a broker. Rather, we are a source of non-dilutive private capital. We offer revenue certainty for project developers through a guaranteed floor price for carbon credits and use our balance sheet to support them with long-term offtake agreements. Not only does this enable project developers to expand with confidence, but also creates greater certainty for our buyers who can lock-in future prices.

THE RESPIRA ETHOS

Respira International was co-founded by Ana Haurie and Robin Bowie in 2019. They saw the urgency with which we must address the climate crisis and recognised the role the private sector must play in these efforts. To drive the necessary levels of corporate action, the voluntary carbon market offered great potential. Speaking of the role of high-quality carbon credits in mitigation, Robin said:

“Buying voluntary carbon credits provides an engaging and impactful way for companies to compensate for residual emissions whilst on the pathway to reducing internal emissions. It enables corporations to go beyond what they are mandated to do through regulation.”

He continues:

“Through integrated plans which combine value chain emissions reductions with appropriate use of carbon credits, corporations can set a powerful and engaging example for others to follow.”

Now, four years later, Respira International continues to expand. Our diverse team combines a 30+ year track record in global financial markets with a deep understanding of carbon project development in leading international conservation organisations.

Reflecting on the Respira team, Chris Villiers, Director of Portfolio Management, said:

“Respira has brought together a team with the network and experience to develop products in the voluntary carbon market that can attract institutional capital at scale that will be used towards reducing emissions globally and deliver significant climate impact.”

THE TIME IS NOW

Our team knows we cannot delay climate action. In the next seven years, we must significantly decarbonise our economies if we are to meet the targets set by the Paris Agreement. Eva Weightman, Director of Corporate Client Relations, said:

“With 2030 fast approaching, there is no time to sit idle. The world needs business leaders to act with urgency and curb their companies’ emissions if we are to limit global temperature increase to 1.5°C above pre-industrial levels.”

Chief Technology Officer, Jon Mulder agrees:

“The time to act on decarbonisation and nature restoration has never been more critical. The solutions exist today and must be scaled and deployed more rapidly. We all have a role to play and carbon credits provide a vital service in protecting and restoring nature.”

If we are to achieve our 2030 ambitions, Finance Director, Peter Christie, argues that businesses must take voluntary action on climate mitigation.

“In the absence of direct regulation by governments, companies need to voluntarily ramp up their decarbonisation efforts so we can collectively solve the climate crisis. Carbon credits are an essential part of the business toolkit.”

RESPIRA IS COMMITTED TO NATURE

However, carbon credits are not uniform in the benefits they deliver. Credits can be generated from activities which remove carbon from the atmosphere or from projects that prevent additional carbon emissions from release. But regardless of whether a project focuses on removal or avoidance, they can deliver a great many benefits for people and nature. It is with these projects – those with measurable impacts, aligned with the UN Sustainable Development Goals – that Respira partners.

This is why our flagship portfolio focuses predominantly upon nature-based projects such as forest conservation or mangrove restoration. Director Natural Climate Solutions, Ed Hewitt, further explains Respira’s investment rationale.

“There is a critical need to attach a monetary value to services that nature provides such as carbon capture, water quality, clean air and biodiversity.”

Ed continues:

“Carbon is really the first to be monetised at scale. By doing this we can financially incentivise the conservation and restoration of forests, soils and wetlands, helping us address the twin challenges of climate change and nature loss.”

Josh Schaefer, our Portfolio Director, explains that climate change and nature loss are inseparable challenges.

“Global emissions reductions can’t be achieved without tackling nature loss, because the earth’s natural ecosystems absorb roughly half of man-made carbon emissions – as well as providing numerous other benefits for people and biodiversity. Verified carbon credits have proved to be an effective way to finance the protection of natural ecosystems.”

Our CEO, Ana Haurie, concludes with a call to action:

“The time for the financial sector to act on climate is now. The predicted growth of the voluntary carbon market, with an increasing focus on nature-based solutions, provides a unique opportunity for institutional investors to benefit from this new asset class, while also supporting sustainable development goals and making a positive impact,” she said.

We encourage you to view our introductory video to learn more of our non-broker approach. And if you would like to find out more about our team, you can read more here.

Share this article